|

Example 1: Break Even Analysis at Great Threads |

|

|

|

1. How does a change in the response rate affect profit? 2. For what response rate does the company break even? 3. If the company estimates a response rate of 3%, should it proceed with the mailing? 4.

How

does the presence of uncertainty affect the usefulness of the model? |

|

|

|

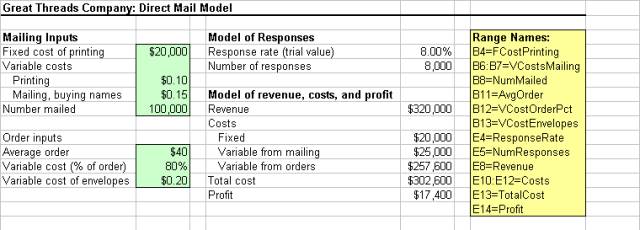

1.

Headings,

range names and input values were entered for the given data 2.

A

model of the responses was created using a reasonable value of 8% in the

ResponseRate cell using the formula = NumMailed*ResponseRate. 3.

A

model of the revenue, costs and profits created in the Revenue cell using the

formula = NumResponses*AvgOrder. 4.

The

formulas =FCostPrinting, =SUM(VCostsMailing)*NumMailed and =NumResponses*(AvgOrder*VcostOrderPct+VcostEnvelopes)

were entered into the Costs cells (E10, E11, and E12) 5.

The

formula =SUM(Costs) was entered in the TotalCost cell. 6.

The

formula =Revenue-TotalCost was entered in the Profit cell. |

|

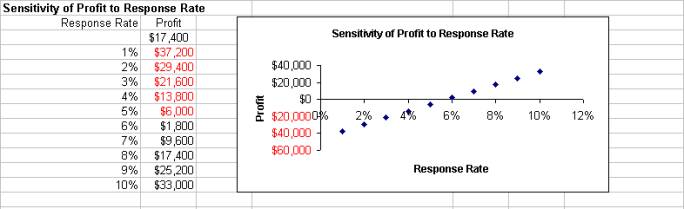

Question 2 – To find the exact breakeven point, the Goal

Seek tool in Excel can help solve a single equation in a single unknown. In

the case of Great Threads, the equation is Profit=0 and the single unknown is

the response rate. Goal Seek generated a ResponseRate value of 5.77% and a

Profit value of $0. As a result, if the response rate is 5.77%, the company

breaks even. If the response rate is greater than 5.77%, the company makes

money. Question 3 – Although results from the data table point to

a loss (negative profit) when the response rate is only 3%, a long-term view

may find this rate acceptable. The fact that many of the customers who

respond to direct mail will reorder in the future should be taken into

consideration. Since the company makes $7.80 per order, profit would be

positive if each respondent orders two more times. As a result, the company

could earn $46,800 or (3000($7.80)(2)) which is more that the model shows. Question 4 – Uncertainty is a factor in this model because

model inputs are known with certainty. However, the degree of uncertainty is

what is significant. In the case of Great Threads, the average size of a

customer order is known although it may vary. Therefore, it is more accurate

to state the probability that Great Threads will break even or their profit

will have a certain value. |

|

|